Central Banks and Interest Rates

_________________________________________________________

Interest Rates - Importance to Forex

Interest rates play the most important role in moving the prices of currencies in the foreign exchange market. As the institutions that set interest rates, central banks are therefore the most influential actors. Interest rates dictate flows of investment. Since currencies are the representations of a country’s economy, differences in interest rates affect the relative worth of currencies in relation to one another. When central banks change interest rates they cause the forex market to experience movement and volatility. In the realm of Forex trading, accurate speculation of central banks’ actions can enhance the trader's chances for a successful trade.

Interest Rates Dictate Investment

Interest rates can be simply defined as the amount of money a borrower must pay to a lender in order to hold their money. In a simple representation of the foreign exchange market, the lender is an investor holding cash or assets and the borrower is a bank inside a particular country. The lender (investor) provides money to the borrower (the bank) and will receive, after a specific time period, interest in conjunction with the original sum he or she put in. Typically, interest is applied as an annual rate or percentage of the amount being lent. In forex trading interest is credited on a daily basis.

A simple example:

A US investor, Jane, wants to place 100 dollars into a savings account with either a domestic or a foreign bank. The US bank’s interest rate is 5.25%. In Japan, the interest rate for a savings account is 0.25% and in New Zealand it is 7.25%. In considering the best investment after a year, Jane can get back $105.25 investing in the US, $100.25 in Japan, and $107.25 in New Zealand. Opening an account and “lending” money to a New Zealand bank is the investment option that achieves the biggest return for Jane.

Jane’s investment decision shows that higher interest rates attract capital. As a result central banks may attempt to draw foreign investment to their countries through higher interest rates.

How Interest Rates Play a Role in the Currency Markets

An increase in interest rates encourages traders to invest within that market and causes the demand for the currency to rise. As demand rises, the currency becomes scarcer and consequently more valuable. Investors are drawn to the currency, causing it to appreciate, because they will gain a higher yield on their investments, as in the Jane example. In order to purchase the country's assets (stocks or bonds), Jane will have to convert her domestic currency to the target country's currency also increasing demand. Conversely, a fall in interest rates dissuades investors from purchasing assets in that economy, as the return on their investment is now smaller. The economy's currency will depreciate as a result of the weaker demand

The Role of Central Banks

Central Banks Set Interest Rates

Bank of England Since central banks, also known as reserve banks, play the crucial role of setting interest rates they need to be followed and studied by a fundamental (and even technical) Forex trader. Central banks want to achieve financial stability of their currency (i.e. battle inflation) and maintain overall economic growth in their country. Their primary responsibility is to oversee the monetary policy of a particular country or group of countries (in the case of the European Union). Monetary policy refers to the various efforts made to effectively control and manage the amount of money circulating within a nation. Skilled investors are able to properly identify which currency will experience an increase in interest rates based upon a central bank’s statements and incoming financial data. Those investors that are correct in their speculations can predict how the respective currencies should move, and as a result should be able to take the proper long or short positions.

Central Bank’s Role in Fighting Inflation

Central banks act in ways to lessen the effects of inflation on an economy. Inflation refers to a rise in price levels which causes a fall in the purchasing power of a currency. Inflation accounts for an entire basket of goods and services, not just an increase in the price of one item. Monitoring prices of a particular basket is known as indexing and provides a reliable method of tracking inflationary movement.

Inflation’s effects can be felt on just about everyone within a society regardless of whether one engages in trading or not. At times of high inflation, employees will demand more money for their work as the previous hourly wage no longer reflects the same value. In order to pay their employees more, businesses have to raise their prices so that they can also manage to raise the wages of its employees.

Inflation and Oil (Example)

Inflation Interestingly, inflation can be set off by the increase in price of just one crucial item (food or energy) as well. An example of a volatile commodity that can cause inflation is oil. An increase in the price of oil would cause many other items that use it as an input in the production process (such as gasoline) to also increase in price and therefore begin the inflationary process. Inflation poses a problem to the population because it erodes people’s wealth and standard of living as their bank accounts and wages seem to diminish while prices get higher. The purchasing power of the currency decreases and the currency loses strength. Therefore inflation’s erosive nature necessitates the actions taken by the central bank.

Affects of Inflation on Interest Rates and Investment

If inflation is a concern then the central bank will raise interest rates to appease the inflationary pressure. Higher interest rates will cause inflation to slow because it will cost more for companies and consumers to borrow from banks to fund either investment spending or consumption (i.e. for consumers it will be harder to refinance a mortgage on a house to free up spending money). With more restrictive access to money, economic activity slows down and so do inflationary pressures.

The higher interest rate will cause the currency to appreciate in the eyes of investors, both domestic and foreign, as they will benefit from a higher yield on the country's assets. If the currency is now appreciating relative to other currencies, then Forex traders will buy into it in order to trade with the trend, sending even more money towards that economy.

It is therefore a delicate balance that central banks have to strike. They would like higher interest rates to strengthen the currency and promote foreign investment, but they must be aware that higher interest rates hurt domestic businesses and consumers that rely on borrowing money from banks.

In the following pages, we shall look at an example of interest rates and central banks, and their impact on the Forex market at work.

Market Reactions to Central Banks - FOMC Example

We will attempt to show how important interest rates are to currency movements by examining price action on the Forex market during a recent central bank tightening campaign. The following example focuses on the EUR/USD pair.

Let’s investigate the implication of the United States Federal Reserve’s interest rate decisions to the value of the US Dollar.

Dollar Gaining

EUR/USD - December 2004 - December 2006:

The Euro started 2005 at a high exchange rate, 1.3500 Dollars per Euro. US interest rates had been hovering at very low rate of 1% prior to this time and the Euro was appreciating. In 2005, on the other hand, there was steady Euro depreciation. The US central bank, the Federal Reserve, continued a campaign, started in July 2005 to gradually raise interest rates from 1%. At every subsequent meeting of the Federal Open Market Committee (FOMC), federal officials increased the base interest rate by .25%. Financial markets reacted to this gradual hiking campaign by favoring and strength ending the Dollar. When 2006 started, the EUR/USD pair traded around 1.2000, a change of 13 cents or 1300 pips. The central bank's actions were a major cause for the Dollar appreciating in 2005.

When the value of the Dollar is rising the chart will be moving downwards. This means that the Dollar is appreciating, or in other words it takes less Dollars to buy the same amount of Euros. When the Euro is doing better price is moving upwards on the chart.

FOMC Example Continued

Let's continue examining how the market reacts to changes in the US interest rate outlook. We turn to 2006.

Euro Uptrend Continues

1. On March 28th the Federal Open Market Committee (FOMC) continued their campaign to hike rates by increasing the base rate for the 15th consecutive time by .25% to 4.75%.

Even though the FOMC raised rates, which would favor the currency, the Euro continued climbing against the Dollar. Investors and traders kept up the speculation that the Federal Reserve was ready to end their campaign. The only question was how much further further they would go.

EUR/USD - December 2005 - May 2006

2. On April 14th, Greg Ip, a prominent Wall Street Journal reporter that follows the Federal Reserve closely, wrote that its officials were divided regarding the need for further tightening, fueling investors’ expectations that the base rate would stop at 5%. This news along with other Dollar negative factors (a standoff with Iran over their nuclear ambitions) accelerated Dollar losses for the next four weeks.

The EUR/USD pair went from trading at 1.2100 to 1.2900 which is a significant 800 pip move that translates to a change of $8,000 dollars for a 1 Lot position. Whether the position gained or lost the 800 pips depends on whether the open position was a buy or sell of the pair.

3. On May 10th, the FOMC met and raised the rate to 5%. In the announcement that accompanied the rate hike the Federal Reserve officials said that “further tightening would depend on incoming economic data”. This statement clouded the intentions of the FOMC for their next meeting, which was scheduled for June 29th. A couple of days later when the pair closed in on 1.3000, it stopped trending and entered a ranging market as investors analyzed what the Federal Reserve would do next.

Federal Reserve Chairman Moves Markets with Hawkish Talk on Interest Rates

Federal Reserve Chairman Moves Markets with Hawkish Talk on Interest Rates

The start of June brought some clarification to investors and traders. The still new Federal Reserve chairman Ben Bernanke, at a speech, said that “recent inflation measures were higher than his comfort zone”. These comments were regarded as highly “hawkish” a term to mean an official that favors higher interest rates. “Dovish” statements are those that favor cutting rates. Bernanke's comments caused the Dollar to immediately strengthen as it seemed that the base rate would not stop at 5%, contradicting the earlier speculation that had built up following the Wall Street Journal news report and analysts predictions.

In the next 7 trading sessions, the EUR/USD moved from 1.2950 down to 1.2550 a change of 400 pips (or $4,000 for a 1 Lot position). We have already explained what role inflation plays in the considerations of central bank officials.

The Dollar strengthened on the changing US interest rate outlook, touching the older upper (green) trendline we had drawn previously in March/April. From this point, the pair enters another, larger ranging market with price bouncing between 1.2900 and 1.2500. The ranging market developed because investors and traders were unsure about what would happen next since higher inflation readings meant that the FOMC could continue raising rates. If inflation did not pose a problem then the FOMC could pause in their rate hiking campaign.

Now that we have taken you through an example of how central banks impact the Forex market let’s take a closer look at the main central banks.

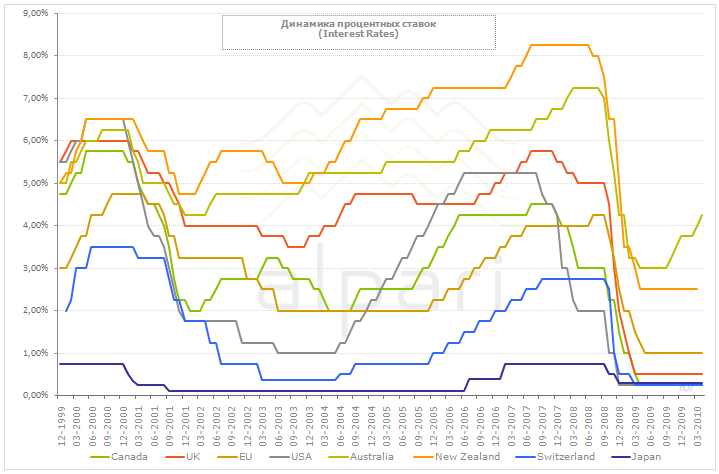

Interest Rates Dynamics

Federal Reserve Bank- United States

The Federal Reserve The most influential bank is the US Federal Reserve Bank because the US dollar is the most heavily traded currency. The Federal Reserve’s Federal Open Markets Committee (FOMC) decides on interest rates and is made up of 7 governors of the Reserve Board and 5 of the 12 district reserve presidents. The Federal Reserve meets 8 times a year and its key official is Ben Bernanke, the chairman of the Federal Reserve. Twelve regional Federal Reserve Banks were created so that the economic operations of the United States can be monitored efficiently.

The FOMC committee meets about every six weeks. The FOMC is comprised of members from the Federal Reserve Board that are both appointed and approved through joint efforts of the President, Congress and regional Federal Reserve Bank presidents. The decisions made by the FOMC are closely watched by investors both within and outside of the US because it gives traders an idea of the economic sentiment, which can be used to predict possible interest rate movements.

Source: Federal Reserve

The Bank of England

The Bank of England consists of a committee known as the Monetary Policy Committee. It is comprised of 9 members, which include a governor, 2 deputy governors, 2 executive directors and 4 outside experts. The main official associated with the Bank of England is a man by the name of Mervyn King who is the governor of the Bank of England. The Monetary Policy Committee meets once every month in order to discuss any policy changes.

Source: The Bank of England

The Swiss National Bank

The Swiss National Bank has a very small committee that consists of just 3 people and is typically more conservative as far as interest rate movements are concerned.

The committee meets quarterly and the key official associated with the Swiss Bank is Jean-Pierre Roth who is the Chairman of the Swiss National Bank.

Source: Swiss National Bank

The European Central Bank

The European Central Bank was established after the creation of the Euro in 1998. It oversees the actions of the other member European central banks such as the Banque de France or Ufficio Italiano dei Cambi. The European Central Bank has a group similar to the Federal Open Markets Committee that helps decide on the changes that may need to be made to monetary policy. The committee is known as the Governing Council and is comprised of 6 members of the executive board of the European Central Bank in addition to all the governors of the national central banks from the countries which use the Euro. The Governing Council meets twice a week but only changes policy at 11 of these meetings. The key official associated with the Governing Council is Jean-Claude Trichet, who is the President of European Central Bank.

Source: The European Central Bank

The Bank of Japan

The Bank of Japan also has a committee that consists of the Bank of Japan governor, two deputy governors along with 6 other members.

It meets once or twice a month and the key official associated with the Bank of Japan is Toshihiko Fukui who is the governor of the Bank of Japan.

Source: The Bank of Japan

The Royal Bank of Canada

The Bank of Canada also has a committee which is known as the governing council. The governing council consists of the governor of the Bank of Canada, the senior deputy governor and four deputy governors. The committee meets about 8 times a year and the key official associated with the bank is David Dodge, who is the governor of the Bank of Canada.

Source: The Bank of Canada

The Reserve Bank of Australia

The Reserve Bank of Australia consists of a monetary policy committee which contains a central bank governor, deputy governor, the secretary to the treasurer and 6 independent members appointed by the government. The committee meets about eleven times a year and the key official for the Reserve Bank is Ian Macfarlane, who is the Governor of the Reserve Bank of Australia.

Source: Reserve Bank of Australia

The National Bank of New Zealand

The National Bank of New Zealand unlike all the other banks has no committee. In fact, all the power of monetary policy lies in the hands of one individual: the central bank governor. The decision is made about 8 times a year by Alan Bollard who is the governor.

Source: Reserve Bank of New Zealand

See more links at Central Banks here >>>

---------------------------------------------------------------

Central Banks

The world’s central banks possess similar forms of operation and structure although their long term goals may vary.

There are eight major central banks within the world economy today:

1. US Federal Reserve Bank (USD)

2. European Central Bank (EUR)

3. Bank of England (GBP)

4. Bank of Japan (JPY)

5. Swiss National Bank (CHF)

6. Bank of Canada (CAD)

7. Reserve Bank of Australia (AUD)

8. Reserve Bank of New Zealand (NZD)

Related Topics

----------- EDUCATION ---------

-------TRADING METHODS ------

--------- FOR TRADERS ---------

-------------- OTHER ------------

_________________________________________________________________________________________________________________________________________

Do you like fx1618?

If you think fx1618.com is cool and want to help fx1618, please tell your friends about it via email and blog (or forum)