What is a Covered Call?

Buying a stock long and shorting a call option of the same underlying security is a common options strategy known as the covered call. The idea behind this strategy is to provide the seller of the option with some income over the short term which lowers their net cost and limits the upside potential of the stock at the same time.

More specifically, the strategy calls for selling short term (1 or 2 months till expiration) call options that are out of the money (have an exercise price higher than that of current stock price). The idea is to do this over and over again until the stock is called away by the buyer of the option.

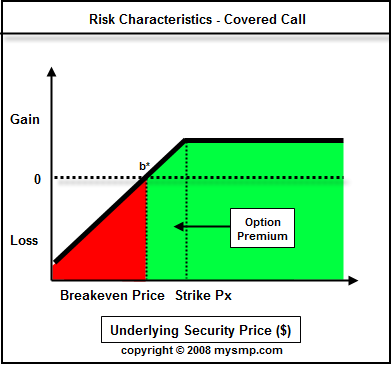

Covered Calls Risk Characteristics

This strategy does not eliminate risk, it just reduces it by the amount of the premium received. Conversely, the opportunity cost of the covered call is equivalent to: Stock Price at expiration - (strike price of call option + call option premium).

Options strategy - Covered Calls

_________________________________________________________

Comparing Covered Calls with Naked Puts

While both of these strategies have the same risk profile, they should both be used with different assumptions.

The covered call options strategy works best in an environment where the stock you are long is steadily rising versus very volatile. The real benefit of selling covered calls is the month over month income that can result if the stock does not get called away. You can basically write options every month as long as the stock does not close above the call option strike price. That will continue to lower the net cost of your purchase price of the stock itself. The idea is to sell premium with a strike price high enough that it won’t be hit during the option duration.

In comparison, selling "naked" puts is a very speculative move. If the underlying stock drops unexpectedly, the put writer is exposed to great risks. There are two reasons one would employ this strategy; one is for short term speculation that a stock will move higher in price in a short term timeframe rendering the put worthless or second, the writer of the option expects a small drop below the strike price at expiration which is less than the premium of the option. This will allow them to buy the stock at a discount. For example, assume stock A is at $50 currently and that the 1 month 50 put option is trading at $2.75. The breakeven of this put is $47.25. As long as the stock stays above $47.25 and below $50, the put writer is in a profit position.

Another key difference between the covered call and naked put is that the covered call strategy requires much more capital upfront to fund the purchase of the stock. However, since the put is short, the writer will be on the hook at options expiration to purchase the stock if the option is exercised. In reality, most brokerage accounts will limit your buying power by the amount of the potential purchase that would result from the put being exercised.

Let's turn to an example:

Purchase Price of Stock

|

$50.00

|

$50.00 Strike Put

|

$3.25

|

$55.00 Strike Call

|

$1.5

|

Months Till Expiration

|

2

|

In this example, if one went long the stock and short the call option, the breakeven would be at $48.50. If the stock closed above $55.00 at expiration, the stock would be called away resulting in a $6.50 profit on $55, or about 12% in 2 months time. Not bad. Now here is the trick, if the stock closes below $55.00 at expiration, the call is worthless and you can turn around and short a call again expiring next month. Now, this strategy will not protect you against sharp declines in a stock; the synthetic call would be better suited for that type of action. The premium from selling the call will only reduce the potential losses by the amount of the premium received.

A naked put from our example above would have a breakeven price of $46.75. If the stock moves above $50 at expiration, the entire premium will be profit. If the stock stays above $46.75 and below $50.00, the option will be exercised and the put writer will be on the hook to buy the stock from the put holder. If the stock drops below $46.75, the put writer will be suffering losses.

Selling Shorter Term Options is Less Risky

There are two key reasons for selling shorter term call options in the covered call strategy. For one, shorter term options command a higher daily premium than longer term options. This seems like a no brainer since you not only get higher premiums, but there is less time related risk; the longer the option, the more risk there is. Secondly, shorting options creates a situation of unlimited risk and again, the shorter the timeframe, the less the risk.

Conclusion

The covered call options strategy can be a great income generating strategy for a stock that is trading in a general, yet controlled uptrend. It may not work as well in a very volatile stock as the odds of the stock getting called away become greater and so does the risk to the downside. On the flip side of the coin, covered calls can greatly limit your profits in a strongly up trending market.

Related Topics

Options strategies:

----------- EDUCATION ---------

-------TRADING METHODS ------

--------- FOR TRADERS ----------

-------------- OTHER ------------

---------------------------------------------

_________________________________________________________________________________________________________________________________________