What is a Collar Option Strategy?

The collar option strategy is designed to provide an extremely low risk strategy to trading stocks. While they may not produce the largest returns, you will not suffer large draw downs either. In fact, if you set the collar up correctly, you may even be able to create a risk-free trade scenario. A collar option is a long term strategy that employs the use of LEAP options. Collar options, or option collars, can be created by going long the stock, long the LEAP puts near the strike price, and then selling LEAP calls that are out of the money.

Collar Option Risk Characteristics

Collar options, if successful, offers a greater reward to risk ratio; they are mostly used by traders who cannot afford to take the risk of volatility in the markets but would like to take a chance at making a better rate of return than the banks offer.

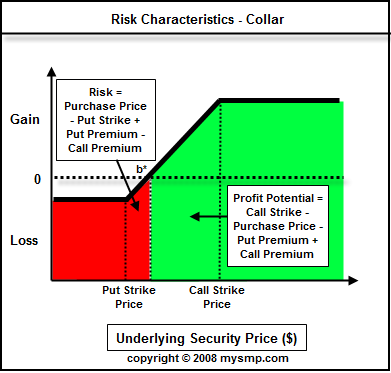

Let's review the risk graph below and talk about the risks and rewards related to a collar option.

Options strategy - Collar

_________________________________________________________

The risk in any collar can be defined with the following formula:

Risk = Stock Purchase Price - Put Strike + Put Premium - Call Premium

The graph above depicts a scenario in which the stock is purchased at the put option strike price. If the trader was astute enough, a collar could be created where a riskless position was taken on. To do that, the risk equation must net a result below 0. For example, if one was to purchase the stock lower than the put strike by a spread greater than that of the put/call spread, a riskless position would have been put on. I have even seen situations where the stock was trading at the put strike and the put/call spread was negative meaning a net credit (put premium less than call premium) situation was derived from writing the options. This was a "riskless" trade.

The profit potential in any collar can be calculated with the following formula:

Profit Potential = Call Strike - Stock Purchase Price - Put Premium + Call Premium

When the collar option strategy are created with LEAPS that expire 18 months out or further, I have seen an potential returns of 15% to 25%. Obviously, the more risk you take with the selection of your strike prices and also with a greater duration on the option, the more potential there is for larger gains.

Collar Option Trading Example

Let's look at a real life example of a collar option trade so you can get a better idea of how it works. Below, you will see a snapshot of the calls and puts for Research in Motion (RIMM). It is currently Jan 2007 and therefore, the example will deal with LEAPs that are only 1 year out in expiration; this should be fine for our purposes.

Note the price of the stock is $103.35. Therefore, assume we buy the stock at this price and sell the puts that are closest in strike; this would be the Jan 2009 puts with a strike of 103.75. For the sake of this example, we will buy the put at market which would be $22.60. To fulfill the second half of this strategy, we would need to sell calls that are out of the money. Let's short the Jan 2009 call options at market for $19.50. Using this data, we can now calculate our risk and profit potential to determine if this trade is appropriate to take for our risk tolerances.

Risk of Collar Option = $103.35 - $103.375 + $22.60 - $19.50 = $3.075. This represents a risk of about 3%. Now, let’s calculate the profit potential so that we can determine the reward to risk ratio.

Profit Potential of Collar Option = $120 - $103.35 - $22.60 + $19.50 = $13.55, or about a profit potential of 13.1%.

This represents a reward to risk ratio of 4.4:1. Not a bad deal.

What happens if the stock is above $103.375 but below $120 at expiration? This is where the calculation of breakeven is necessary. We need to understand at what price we will make money. This can be done by taking your purchase price, $103.35 in our example, and adding the put/call spread which is $3.10 to yield a breakeven price of $106.45. As long as the stock stays above that price 1 year from now, you will be in a profit position.

Therefore, we can say that the breakeven of this trade can be calculated using the following formula:

Collar Strategy Breakeven = Stock purchase price - Call Premium + Put premium

Conclusion

In conclusion, the collar option strategy is great for those who cannot risk a large sum of money but still would like to take a shot at making a decent buck. While the gains may not be spectacular, you will be able to sleep comfortably at night. Keep in mind that a collar requires patience; it will not be easy to sell the options or the stock before the expiration of the options. Collar options are meant to be held until options expiration.

Related Topics

Options strategies:

----------- EDUCATION ---------

-------TRADING METHODS ------

--------- FOR TRADERS ----------

-------------- OTHER ------------

---------------------------------------------

_________________________________________________________________________________________________________________________________________