What is a Call Ratio spread?

A Call Ratio Spread is an options strategy for traders who believe that the stock go sideways to down until expiration of the option. The strategy consists of buying 1 in the money call and selling 2 out of the money calls on the same underlying security and expiration date. The only thing that will be different is the strike price of the options. Additionally, the ratio of options we suggested above is only for example purposes; it could be 2 Long / 3 Short or any ratio that the investor chooses. The objective is to put the trade on as a credit transaction.

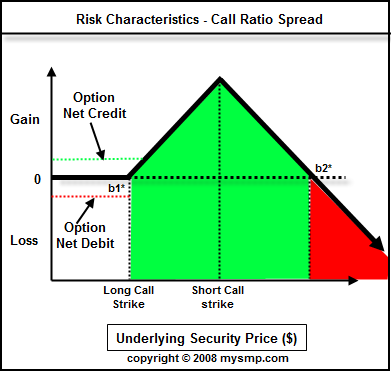

Call Ratio Spread Risk Characteristics

The call ratio spread puts a lid on the profits and allows for unlimited losses. If you can select options such that you can receive a net credit balance, you will guarantee profits if the stock remains below the higher priced strike. We will talk about breakevens in a bit. The further the stock moves above the higher strike, the more you will lose.

Options strategy - Call Ratio Spread

_________________________________________________________

As you can see on the graph above (marked with the red and green horizontal dashed lines), your monetary risk when the security moves to the downside is limited to the net debit that you paid to initiate the options position. If you received a net credit, you will have locked in a gain no matter how low the stock goes. Conversely, your risk when the stock moves increasingly higher is unlimited.

Profit Potential of Call Ratio Spread = Proceeds from Short Call + (Highest Strike - Lowest Strike) * # of Long Call Option Contracts

Breakeven Calculations

As noted in the diagram above, there are two breakeven points. Here are the calculations for the upper and lower breakeven points.

b1* = Long Call Strike + Net Debit Paid

A quick note on breakeven *b1; for a net credit transaction, there is no specific breakeven point, when the stock drops below the lower strike, you have locked in the credit spread and have no downside risk.

b2* = Short Call Strike + Profit Potential / (# of Short Call Options - # of Long Call Options)

To make it a little more tangible, we have included a simple spreadsheet that allows you to calculate the breakeven with a few simple inputs. Please update only the highlighed fields to get the breakeven numbers.

Call Ratio Spread Example

Let's take a look at a live example. We will use the UYG Ultra Financials ProShares as an example.

To construct the call ratio spread, we are going to select one ITM and two OTM call options. We will use the September 19 and September 22 Call Options for this example.

Using our spreadsheet above, we can see that we entered into a net credit transaction of $.15. The premise here is that we need the stock to stay below $25.15 to remain in a profit position. As the position moves above $25.15, the strategy begins to lose due to the fact that we have more short calls than long.

Related Topics

Options strategies:

----------- EDUCATION ---------

-------TRADING METHODS ------

--------- FOR TRADERS ----------

-------------- OTHER ------------

---------------------------------------------

_________________________________________________________________________________________________________________________________________