What is the Butterfly Option Spread?

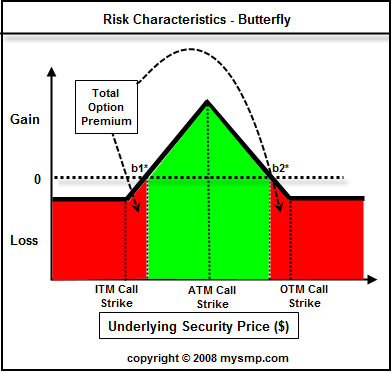

The butterfly spread is put together to create a low risk, low reward options strategy and is designed to take advantage of a market or stock that is range bound. The butterfly can be created using call or put options. The strategy is termed "butterfly" due to the shape of the risk characteristics graph you see below; notice the two wings and then the larger body. The butterfly spread is constructed through buying 1 long ITM call, shorting 2 ATM calls, and buying 1 long OTM call. The ratio between the 3 options should be 1:2:1 and the distance between the strike prices of the long options should be equidistant from the short call strike. For example, a butterfly spread could be made of 3 call options with strikes of 100, 105, and 110.

The butterfly will result in a net debit transaction as the ITM and OTM call options will total a larger value than the two short ATM calls. While the transaction is relatively low risk, the reward will be limited as well. If you break the structure of the butterfly down, you are essentially buy a bull call spread and a bear call spread.

Butterfly Spread Risk Characteristics

Let's review the risk characteristics of the butterfly spread.

Options strategy - Butterfly Spread

_________________________________________________________

As you can see in the risk diagram, the maximum risk of this position is merely the net options premium that was paid to create the butterfly spread. If the security is below the strike of the ITM call or above the strike of the OTM call at expiration, the net debit will be lost and the maximum risk will be assumed.

Risk = ITM Call premium - ATM Call premium + OTM Call premium.

Similar to straddles and strangles, the butterfly spread has two breakeven scenarios:

Breakeven *b1 = Lowest Strike + Risk

Breakeven *b2 = Highest Strike - Risk

If the security stays within these two boundaries at expiration, the butterfly spread will be in a profitable position. The butterfly will yield the maximum gain if the security closes at the middle strike price. The will render the short calls worthless and also render the highest strike call worthless as well.

Profit Potential = Middle Strike - Lowest Strike - Risk

How to find a candidate for a Butterfly

Trading Range

Let's review a few criteria that should be considered before putting a butterfly on. First, we want to be able to locate range bound stocks. The trick is to be able to spot a situation in which a volatile stock is getting ready to get range bound. This can often be seen when stocks have tremendous price moves accompanied by a heavy expansion in volume and also by an intra-period reversal. These types of moves are known as "blow-off tops" and tend to provide strong resistance going forward. See our section on candlestick charting reversal patterns to better understand some common reversal setups using candlestick charts. The low point, following the top, is referred to as the reaction low and this can now be used as your lower boundary of the trading range. Now, you want to wait for the security to make a 50% retracement back into the middle of the range and then initiate the butterfly.

News Announcements

Remember, you want the security to stay within a trading range. That means that you need to make sure there are no news announcements or earnings releases due before the expiration of the option. While it will be nearly impossible to avoid news releases in the market, you want to try and avoid major releases such as CPI, GDP, or housing data (especially if you have a butterfly on a housing stock!)

Selecting Time to Expiration

Typically, butterflies are most effective when initiated with expirations between 1 and 2 months out. You do not want to allow too much time for the stock to break through the trading range so less is more in this situation. Additionally, time decay, or theta, will be greater since the option is closer to expiration. That will bode well considering the two short ATM calls that are involved in this strategy.

Butterfly Example

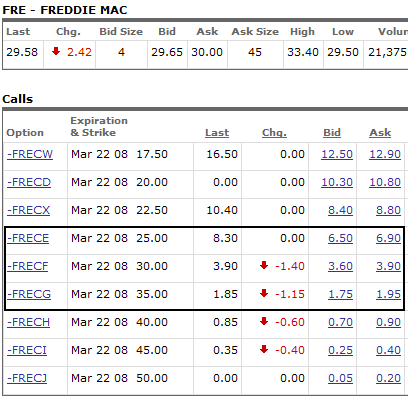

Let's look at a real life example of a butterfly spread so you can get a better idea of how it works. We are going to work with an example using Freddie Mac (FRE). The stock has recently spiked down on gigantic volume and this put the base in of the trading range. As mentioned above, the rally following the bottom usually sets up the top of the trading range. Reviewing the graph below, you can see that FRE has setup a range between $25 and $35 and it is currently trading right near the middle of that range, at $29.58.

Now that we have the ideal graph to trade a butterfly on, let's take a look at the call options chain. Note that are going to go long into 2 month premium. It is currently Jan 2008.

To establish the butterfly spread, we will buy the 25 and 35 strike options and short the 30 options. Therefore we would establish a net debit balance by putting this trade on, and as we suggested earlier, the net debit represents the risk in the trade as well.

Risk of Butterfly = $6.90 - 2 * $3.60 + $1.95 = $1.65

Remember, we want this stock to continue and remain range bound up till expiration and therefore, our breakevens are calculated based off of the lower and upper boundaries of the butterfly spread.

Breakeven *b1 = $25 + $1.65 = $26.65

Breakeven *b2 = $35 - $1.65 = $33.35

Profit Potential of Butterfly = $30 - $25 - $1.65 = $3.35

What if the stock is not above or below the breakeven points suggested above at expiration? Well, lets say that the stock closes at $26 at expiration. You would be able to calculate your profit/loss using the following formula:

Profit/Loss at expiration if stock closes between Lower Strike and Middle Strike = Closing Price - Lower Strike - Risk

Profit/Loss at expiration if stock closes between Upper Strike and Middle Strike = Higher Strike - Closing Price - Risk

Conclusion

In conclusion, the butterfly spread is a great technique to trade a range bound stock. The key is to buy shorter term premiums and to put the odds in your favor by getting into securities that do not have any news related events during the term of your option. The risk of a butterfly spread is fairly low; however, the reward is as well.

Related Topics

Options strategies:

----------- EDUCATION ---------

-------TRADING METHODS ------

--------- FOR TRADERS ----------

-------------- OTHER ------------

---------------------------------------------

_________________________________________________________________________________________________________________________________________