What is a Bull Put Spread?

As the name suggests, the bull put spread is a bullish options strategy and consists of one long and one short put. The bull put spread buys an OTM put option and sells ITM put options and therefore results in a net credit transaction. Since the bull put spread is a credit transaction, it can be used as a monthly income strategy as opposed to its bull call spread counterpart which is a net debit transaction. Another key difference between the two is the volatility structure of puts and calls. Typically, call will have better spreads than puts and provide better reward to risk opportunities. In general, bull put spreads are used to generate short term income.

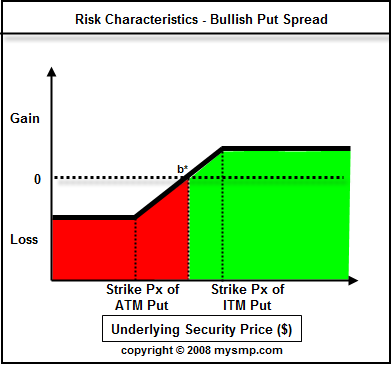

Bull Put Spread Risk Characteristics

The risk characteristics of the bull put spread are similar in structure to the bull call spread however, there are a few key differences. The breakeven price is lower for this strategy and the put strategy is capable of producing a much higher monthly yield.

Since the transaction is a net credit, the risk of the put spread is the difference between the strike prices of the options minus the net credit received. The profit potential is simply the net credit received. Remember, when the stock price moves above the highest strike price of the spread, both options are worthless and therefore, you bank the net credit balance received.

Finally, the breakeven point of this strategy can be calculated as follows: Higher Strike Price - Net Credit Received. In the next section, we will cover this in more detail.

Options strategy - Bull Put Spread

_________________________________________________________

Bull Put Spread Versus Bull Call Spread - Live Trading Example

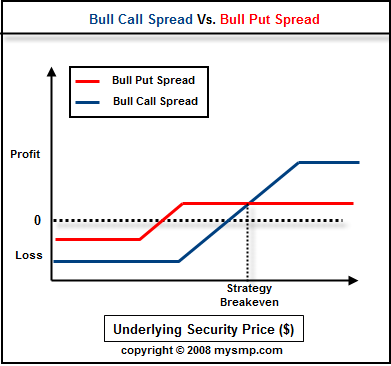

While both strategies are meant for an up trending market, they are both fundamentally different as far as the expectation that are placed upon them. Let's review the risk, reward, and breakeven scenarios of the two strategies using a live example. The diagram below depicts the profit loss comparison between the bull call spread and bull put spread.

Let's review a real life example to make this more clear. We are going to use a Goldman Sachs options chain for our example.

Goldman is currently trading at $198.74 on the close. To create the bull put spread, we would sell a put option near the strike price and buy a put option out of the money. In this case, we will sell the Feb 200 puts at $10.20 and buy the Feb 190 put at $6.40 for a net credit of $3.80. Our anticipation is that the stock will move higher over 200 by expiration.

Using this scenario, we can derive the following conclusions:

Maximum Risk of Bullish Put Spread = Short Put Strike - Long Put Strike - Short Put Premium + Long Put Premium = $6.20

Breakeven of Bullish Put Spread = Short Put Strike - Short Put Premium + Long Put Premium = $200 - $10.20 + $6.40 = $196.20

Profit Potential of Bullish Put Spread = Short Put Premium - Long Put Premium = $10.20 - $6.40 = $3.80, or 1.9%

Looking at these numbers, the bull put spread would clearly not be a great reward to risk scenario for this stock. The potential gain is half of the potential loss. Let's take a look at a similar setup for the bull call spread.

To understand how the following numbers are derived, see our article on the bull call spread.

Maximum Risk of Bull Call Spread = $4.50

Breakeven of Bull Call Spread = $204.50

Profit Potential = $5.50

While the reward is larger than the risk, the ratios still do not provide enough of a potential reward for the risk you are taking.

How do you select the strike prices and expiration dates for the short put and long put?

As far as expiration dates are concerned, you are a net seller of put option premium and therefore you want to select shorter term options (1 to 2 months till expiration) to allow the other side the shortest amount of time to make good on the option. This is opposite to the bull call spread where you are a net buyer of premium and want to allow yourself as much time as possible.

Moving to the strike price selection; typically, you want to look to buy an at the money or near the money put and sell an out of the money put, usually at at the next 5 point increment downward for stocks below 100 and between 5 and 10 points lower for stocks above 100.

Conclusion

The bull put spread is good strategy to produce a monthly income and allows you the flexibility to find a new opportunity within a short amount of time. Rolling this strategy every month can net you great returns at year end; however, there are some downsides. Due to the nature of put options volatility, it can be difficult at times to find the right reward/risk ratio that you are looking for to make this trade worth the time and the upside is usually small. The bull put spread is a low risk low reward strategy.

Related Topics

Options strategies:

----------- EDUCATION ---------

-------TRADING METHODS ------

--------- FOR TRADERS ----------

-------------- OTHER ------------

---------------------------------------------

_________________________________________________________________________________________________________________________________________