What is a Bull Call Spread?

As the name suggest, a bull call spread is an option strategy designed to work when the prevailing trend is higher. The bull call spread does a great job of allowing you to take part in a bullish move by reducing your risk and breakeven points while at the same time, providing great returns. The bullish call spread can be created by buying lower strike calls and selling, or shorting, the same number of higher strike calls with the same expiration. It will cap your profit potential but limit your downside at the same time if the stock does not go up as you expected.

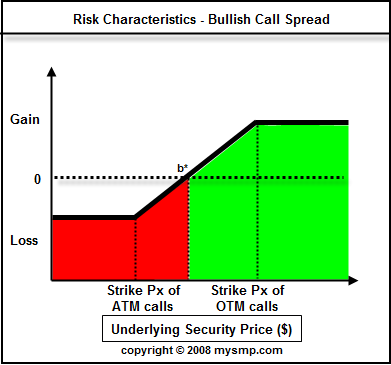

Bull Call Spread Risk Characteristics

Since you do not need to own the underlying stock in this strategy, the risk involved with putting a bull call spread on is simply the net debit that is paid to initiate the strategy and at the same time, there is profit potential above the breakeven point up until the strike price of the out of the money call that was shorted.

Options strategy - Bull Call Spread

_________________________________________________________

What is the difference between the Bull Call Spread and buying a single Call Long?

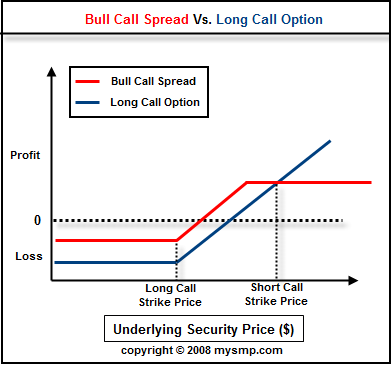

Through the graphic below, you can see that there is greater risk and reward when using just a long call option versus the bull call spread. The long call has the potential for unlimited gains, however, it carries with it a higher breakeven than the spread.

Let's review a real life example to make this more clear. We are going to use a Citigroup options chain for our example.

Citigroup is currently trading at $27.49. To create the bullish call spread, we would go long the March $27.50 calls and short the March $32.50 calls. This would total a net debit amount of $2.29 - $.63, or $1.66 for the spread.

Using this scenario, we can derive the following conclusions:

Maximum Risk of bullish call spread = Long Call Premium - Short Call Premium = $1.66

Breakeven of bullish call spread = Long call strike price + Risk = $27.50 + $1.66 = $29.16

Profit Potential of bullish call spread = Short call strike price - Long call strike price - Risk = $32.50 - $27.50 - $1.66 = $3.44, or 12.5%

Now, let's perform this analysis for the long call only.

Maximum Risk of Long Call = Long Call Premium = $2.29

Breakeven of long call = Long call strike price + Risk = $27.50 + $2.29 = $29.79

Profit Potential of long call = Unlimited after stock breaks above the breakeven point.

At expiration, your profit will be: Price of stock at expiration - Long call strike - Risk.

So using this example, we have to ask ourselves the following question, do we think that Citigroup's stock price will be above $32.50 at expiration? If the answer to that question is NO, then the bull call spread is the better strategy to use. Additionally, if you are risk averse, the bull call spread would also be the better strategy. It will cap your gains as shown above and for that reason, if your expectations are for much further price appreciation, shorting the out of the money calls would not be a good idea.

How do you select the strike prices and expiration dates for the long call and short call?

This is not very complicated, my general rule of thumb is to buy near the money or at the money calls and sell out of the money calls. The strike price of the option you SELL should be high enough to allow the stock to run a bit but low enough that you can actually get a decent premium for the options you sell. I look for between a 2:1 and 3:1 ratio of reward to risk.

To get the biggest bang for your buck, you may want to look for options that expire between 6 and 12 months. I find the premiums to be conducive to this strategy in this timeframe.

Related Topics

Options strategies:

----------- EDUCATION ---------

-------TRADING METHODS ------

--------- FOR TRADERS ----------

-------------- OTHER ------------

---------------------------------------------

_________________________________________________________________________________________________________________________________________